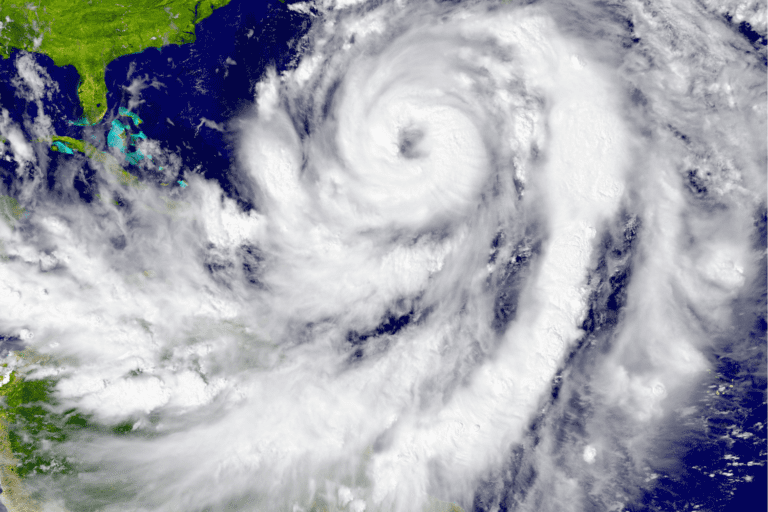

Louisiana Hurricane Resources & Evacuation Routes/Maps

Louisiana Disaster Preparedness – Family Disaster Plans, Supply Kits, Statewide Emergency Numbers etc.

Louisiana Hurricane Deductibles

There are three deductibles for homeowners policies related to wind damage: hurricane, named storm and windstorm and hail. Named storm deductibles are activated when the National Hurricane Center reports that a storm reached tropical storm strength when winds reach 39 miles per hour (mph). Hurricane deductibles are activated when the National Hurricane Center reports that a tropical storm reached hurricane strength, at 74 mph. Windstorm and hail deductibles are used when homes sustain damage from winds from any source: hurricanes and tropical storms, tornadoes, or other storms.

Insurers generally cannot increase the named storm or hurricane deductible on homeowners insurance policies that have been in effect for more than three years. Insurers cannot impose more than one named storm or hurricane deductible per hurricane season.

State regulations mandate that homeowners may be eligible for premium discounts if they build or retrofit their home to comply with the state’s construction code or install mitigation or retrofitting improvements that are known to reduce loss from a windstorm or hurricane.

Most homeowners coverage in coastal areas is underwritten by the Louisiana Citizens Property Insurance Corporation.

The Louisiana Citizens Property Insurance Corporation provides insurance for residential and commercial property for those who cannot obtain it in the voluntary market. The Louisiana Citizens FAIR Plan and the Louisiana Citizens Coastal Plan operate as programs of the Louisiana Citizens Property Insurance Corporation. Both offer wind and hail only policies. See website for details.