The 2022 catastrophe season, with an estimated $53B – $74B in insured losses from Hurricane Ian alone, is poised to deal a far-reaching blow to a shaky property insurance market already facing multiple pressures.

With rising inflation and possible recession, insureds and their brokers will need to get even more strategic to navigate renewals.

The 1/1 renewal season is almost upon us, so we’ve put together some clear steps to help you get started on effective planning and disciplined execution.

Key Steps:

- Reassess risk tolerance

- Confirm coverage requirements

- Prepare a complete property program strategy

Complete these steps at the beginning of the renewal process to avoid claims nightmares and lead the process with underwriters. It’s important, too, to know what to expect when navigating the 2023 renewal season. Read on to learn more about trends we’re seeing and strategies we recommend.

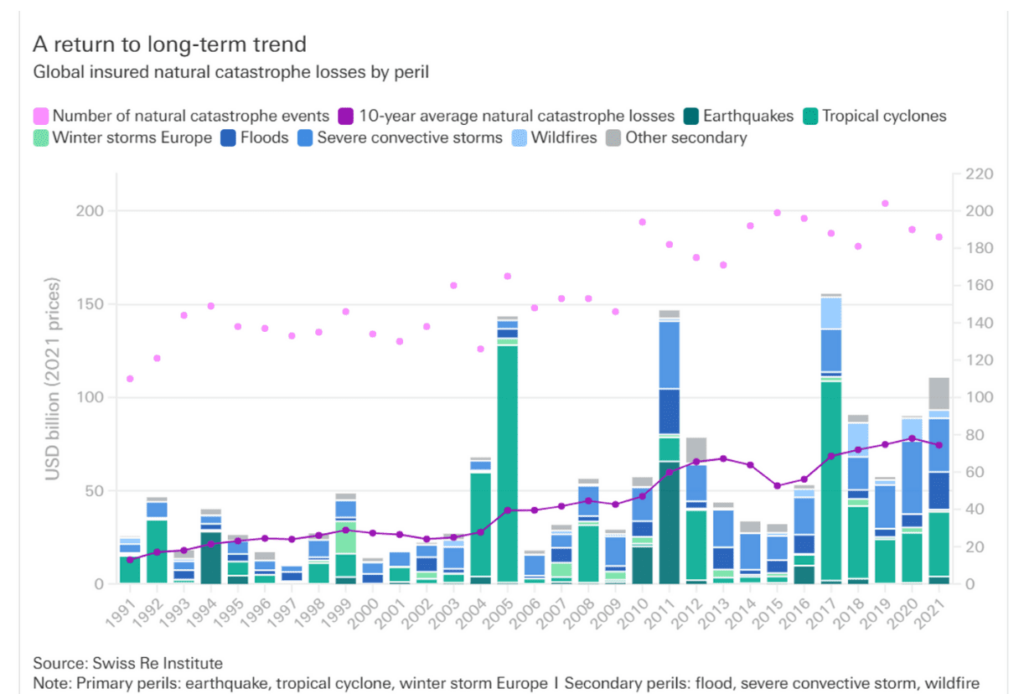

Global Insured Natural Catastrophe Losses by Peril

Reinsurance Market

Reinsurers faced capital challenges, rampant inflation, climate change, and investors fleeing to other investments with higher returns even before Hurricane Ian.

The recent cat activity is likely to accelerate the following preexisting factors:

- The 1/1/22 reinsurance renewals were flat to modestly up, but spring and mid-year renewals increased more significantly due to the record-setting inflationary environment driving up claim costs and property valuations.

- Cat model projections show claim expenses increasing up to 30% due to materials, labor, and other factors.

- More capital isn’t expected to enter the market to slow the hard market impact.

The combination of these factors suggests that, moving into 2023, we’ll be facing the most challenging cat property market since the mid-2000s.

Primary Market

The near-term trajectory for primary insurance markets looks grim. Shortages of materials and labor constraints added pressure on loss costs and ultimately insurers’ profitability in ’22. Today, it is clear renewals will become more difficult because of the property insurance landscape.

- The combined ratio, a measure of underwriting profitability (incurred losses plus expenses/premium), has been over 100% in 3 of 5 years for commercial property insurers. Hurricane Ian will lead to another year of net underwriting loss.

- We expect carriers will retreat from cat property to lines where they feel they can grow safely. Expected reinsurance rate increases will be a catalyst here.

- Primary insurers continue to deal with inflation, which in turn has been driven by supply chain issues and shortages of skilled labor. This inflationary environment has also spotlighted the accuracy of property valuations.

- Underwriting scrutiny will increase, which means expectations around accurate valuations, descriptions of property loss controls, lessons learned on prior claims, and disaster recovery plans will heighten.

- Carriers will be seeking higher retentions, restricting coverage terms, and exercising limits management, among many other strategies to manage their exposure.

7 Steps for an Effective Renewal Experience

Here are some clear steps to help clients create the most favorable result possible in today’s challenging conditions.

- Develop a Strategy for Your Next Renewal and Put it in Writing. Begin as many as four months before coverage is bound (or as far in advance as possible). If strategies are not put in writing, then accountability can be lost for clients and brokers.

- Evaluate Risk Tolerance. Understand how much coverage you are purchasing and how deductibles impact your liabilities. Don’t let your brokers be complacent about the minimum insurance requirements for assets and evaluating creative program structures like deductible buydowns, deductible indemnity agreements, deductible reimbursement policies (captive), and parametric insurance (loss mitigation). Insureds with higher risk tolerances can lower premiums after reviewing for financial feasibility.

- Use Data to Your Advantage. Keep property schedules up-to-date and accurate to maximize negotiations. Use cat modeling and other emerging analytics tools to structure your carrier RFP and enhance your negotiating leverage. Such resources can help estimate the likelihood of a loss, how much insurance to buy, and how much an underwriter should be charging you (most applicable to larger portfolios).

- Reconcile All Valuations. Most carriers require higher replacement cost values for assets they insure. Insureds and brokers need to confirm all assets are measured accurately. The impacts of increasing square footage replacement costs need to be evaluated as many months as possible before renewal.

- Develop a Thoughtful Negotiation Strategy. Flooded with daily submissions, underwriters rely on data to properly evaluate your risk. Be sure to highlight specifics and safeguards in place that make your property a preferred or favorable risk. When submissions are broad and incomplete, your risk will likely be put to the bottom of the pile and may not receive adequate consideration.

- Demand a Detailed Coverage Analysis. Both the broker and insured should have full policy forms and endorsements on file. Doing an audit of all policies ensures coverages are adequate and meet your goals. In a hard market, insurance companies will look to include endorsements and policy language that remove previously included coverages once included. Address all policy changes.

- Implement a Stewardship Plan. Work with your broker to hold stewardship meetings to keep everyone informed of current market conditions and what to expect at renewal.

A word to the wise: Approach renewal season with patience and a strategic plan. Contact us to make sure you are ready.

This material has been prepared for informational purposes only. BRP Group, Inc. and its affiliates, do not provide tax, legal or accounting advice. Please consult with your own tax, legal or accounting professionals before engaging in any transaction.

Comments are closed.